Accessory Dwelling Units (ADUs) in Southern California are becoming increasingly popular as a solution for affordable housing. Understanding what factors contribute to the affordability of these units can help homeowners and investors make informed decisions. In this blog, we’ll explore the key aspects that make an ADU financially accessible.

Understanding ADU Construction Costs in Southern California

The first step in determining affordability is grasping the construction costs associated with an ADU. This includes materials, labor, and any additional fees.

Construction costs can vary widely based on the size and complexity of the unit. For instance, a simple studio may cost significantly less than a two-bedroom ADU. By conducting thorough research, homeowners can find ways to trim expenses, such as choosing cost-effective materials or employing local contractors.

Moreover, unexpected costs can arise during the construction process, especially if the property requires extensive site preparation. Thus, having a buffer in the budget can help alleviate potential financial strain.

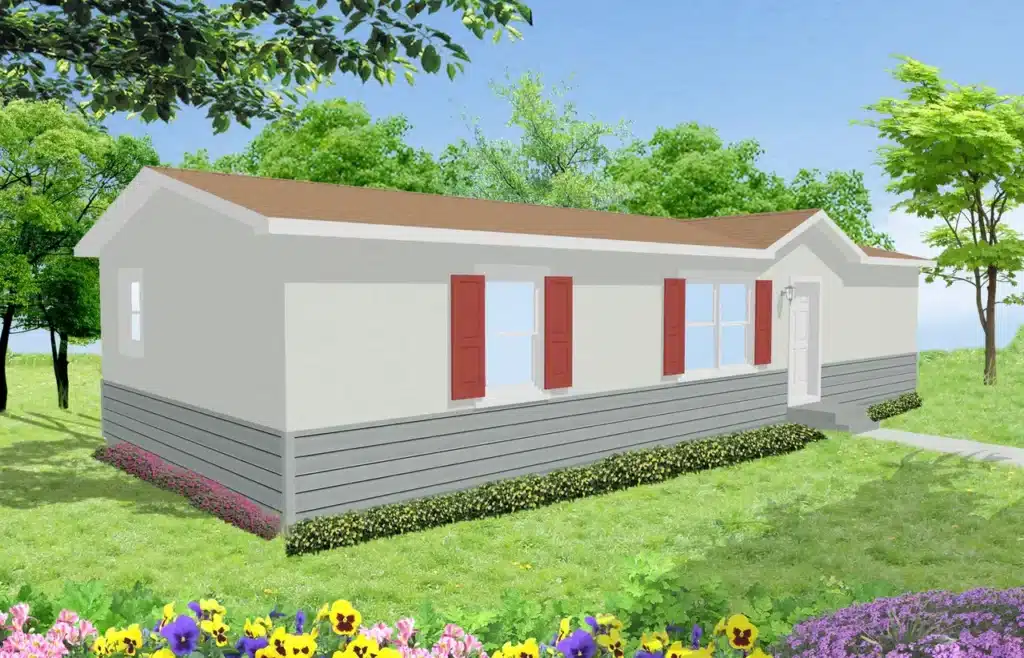

“A popular option to minimize overall cost of building an ADU in Southern California is building a prefabricated ADU . These homes are built in a factory , just like a car, on a production line and are high quality homes yet cost is lower than a traditional site built ADU.” says Bill Cavanaugh VP of ADU experts www.MyADU4Less.com

All things considered, planning meticulously for construction costs can pave the way for a more affordable accessory dwelling unit. Knowing the fiscal landscape not only aids in budgeting but also empowers homeowners to negotiate better deals.

Choosing the Right Location

Location plays a crucial role in pricing. Areas with high demand may increase costs, while more affordable neighborhoods might offer better opportunities.

Selecting a location that balances accessibility with affordability is paramount. Consider regions that are on the rise but have not yet reached peak prices; this often leads to a sweet spot where costs remain relatively low, but the neighborhood is set to grow.

It’s also essential to examine local amenities. Proximity to schools, parks, and public transportation can add value, making an ADU potentially more desirable and, thus, financially viable in the long term.

Thus, scouting for the right location isn’t merely about current prices; it’s about envisioning future value, accessibility, and the lifestyle it offers. This foresight can significantly influence the overall affordability of your accessory dwelling unit.

Design Features that Save Money

Smart design choices can enhance affordability. Opting for efficient layouts and sustainable materials can lower both initial and long-term expenses.

For example, compact designs reduce the need for excess materials and labor. An open floor plan maximizes utility while minimizing wasted space, allowing you to get the most out of each square foot. This type of design not only reflects an eco-friendly approach but also significantly cuts down on costs.

Furthermore, incorporating energy-efficient appliances can lead to savings on utility bills over time, making the ADU not just affordable upfront, but also sustainable in the long run.

Choosing long-lasting materials, like metal roofing or fiber-cement siding, can provide durability that pays off by reducing maintenance costs. Every design decision impacts the overall affordability, so careful consideration is key.

Navigating Local Regulations

Understanding zoning laws and regulations is essential. Compliance can lead to cost savings and ensure the ADU can be built and rented out legally.

Many municipalities provide resources and documentation that outline the specific requirements for building an ADU. Familiarizing yourself with these guidelines aids in avoiding potential fines or rework, both of which can inflate costs.

Consulting with local planning departments can also provide insights into incentives or grants available for building ADUs. Some areas may offer reduced fees or even tax incentives for meeting local housing demands.

Ultimately, being proactive in understanding and adhering to local regulations not only helps to streamline the construction process but can also contribute significantly to the affordability of your ADU.

Financing Options for ADUs

Exploring various financing options can significantly impact affordability. From traditional loans to government grants, finding the right financial pathway is key.

For those looking to minimize out-of-pocket expenses, numerous financing programs cater specifically to ADUs. Some local governments offer low-interest loans or grants that can help shield property owners from high upfront costs.

Additionally, leveraging equity from existing properties can be a viable strategy. Homeowners may find they can tap into the equity of their primary residence to fund the construction of an ADU transparently and affordably.

Lastly, understanding different loan types, such as construction-to-permanent loans, can help tailor the financial strategy that aligns best with your budget and long-term goals. Each financing decision has a ripple effect on overall affordability.

Wrapping Up

In conclusion, the affordability of an Accessory Dwelling Unit depends on various factors, including construction costs, location, design, and local regulations. By considering these elements, you can make better decisions about investing in or building an ADU that meets your budgetary needs.