Building an accessory dwelling unit (ADU) in Poway can be a dream come true, but the financial aspect can be daunting. Lucky for you, there are plenty of cost-effective financing options available! Whether you’re looking to invest in a rental property or create a cozy space for family, this list will help guide you through various ways to fund your Poway ADU project.

1. Utilizing Home Equity

If you’ve built up equity in your home, using it for your ADU project can be a smart move. Home equity loans and lines of credit can offer competitive interest rates, making it an appealing option. Not only can these funds be used towards construction costs, but they can also help you avoid higher-interest personal loans.

Moreover, tapping into your home equity could come with the added benefit of tax-deductible interest, making it a financially savvy route as your investment pays off. Just make sure you’re aware of your total debt-to-income ratio, as lenders will look closely at your overall financial health.

2. FHA Loans for ADUs

Federal Housing Administration (FHA) loans can be an excellent way to finance your Poway ADU. They often require lower down payments and are accessible for those with less-than-perfect credit. This means that even if you’ve faced financial hiccups in the past, you may still qualify for this financing.

To add a bit more detail, FHA loans allow you to combine the costs of buying or refinancing your home with the costs of building your new ADU, all in one manageable loan. This can simplify your financing situation and help you maintain a clearer cash flow.

3. State and Local Grants

Look into grants offered by state and local agencies for ADU construction. These funds can help offset costs significantly and are often designed to promote housing solutions. Many municipalities, including Poway, understand the importance of increasing affordable housing. Therefore, they may provide financial assistance to encourage homeowners to build ADUs.

Staying informed about these grants can lead to significant savings, especially when you consider there might be little to no repayment required. Research your local government’s housing authority or websites dedicated to housing programs to keep abreast of available opportunities.

4. Personal Loans as a Quick Fix

For a more immediate funding option, you might consider personal loans. They typically have quicker approval times, though interest rates can vary based on creditworthiness. This means if you have a good credit history, you may snag a competitive rate!

Don’t forget that personal loans provide flexibility. You can use the funds however you see fit, whether it’s to cover construction materials or labor costs. Just weigh your repayment options carefully; while this may be a quick solution, ensure it aligns with your long-term financial health.

5. Construction Loans Simplified

Construction loans are specifically designed for building projects. If you’re planning to build a new ADU, these loans can provide short-term financing that covers construction costs. Typically, they work on a draw schedule, allowing you to access funds as needed.

Such a loan can help manage cash flow since you won’t need to pay the entire amount upfront. Additionally, working with a lender familiar with ADU projects can further streamline the process, ensuring you have the right financial support every step of the way.

6. Partnering with Investors

Consider partnering with investors who share your vision. This can help you secure funding while sharing the potential profits from your Poway ADU. Often, investors are looking for viable projects, and your ADU can be an attractive proposition, especially if its rental potential is strong.

Partnerships can also relieve some financial pressure from you as the homeowner, allowing for smoother collaboration. Just make sure you lay out clear agreements and expectations beforehand to prevent any misunderstandings down the line.

7. Relying on Family Assistance

Don’t shy away from asking family members for a loan or investment. They may be willing to help out, often with more favorable terms than traditional lenders. A personal loan from a family member can provide the support you need without the stress of stringent repayment schedules.

However, it’s essential to maintain transparency about the terms to avoid straining relationships. Discuss clearly how much funding you need, how you plan to repay it, and remind them that you are working on an investment that can benefit everyone involved.

8. Savings and Budgeting Strategies

Using personal savings can be one of the most economical ways to finance your Poway ADU. Create a budget and savings plan tailored toward your ADU goals. By setting aside small amounts regularly, you’ll accumulate the needed funds over time.

Don’t forget, budgeting can also unveil other financing routes! When you track your spending, you might discover areas where you can cut back that will allow more savings for your project. Plus, using money you already have means you won’t be accruing any interest or debt—always a win!

9. Crowdfunding Your Project

Explore crowdfunding platforms designed for real estate projects. This can be a creative way to garner support and funding for your ADU from friends and the community. You might be surprised at how many people are willing to invest in a project that contributes to the local housing solution.

Using social media to promote your crowdfunding campaign can amplify your reach, garnering even more community support. By showcasing your vision, potential backers may feel inspired to contribute, especially if they see the community benefits your ADU can provide!

10. Government Loans for Affordable Housing

Various government programs provide low-interest loans for ADU projects, especially when aimed at enhancing affordable housing options in your community. By researching these government-backed initiatives, you might find an affordable route that aligns perfectly with your financial needs.

Moreover, some programs prioritize eco-friendly construction practices, so going green with your Poway ADU could open even more doors for financing opportunities! Be proactive in your search and inquiries to maximize your options.

11. Home Renovation Loans

If you’re converting an existing space into an ADU, home renovation loans may be perfect. They can help cover upgrades and modifications needed to meet local regulations. This can sometimes be less expensive than starting from scratch with a new build.

Additionally, many renovation loans consider the after-improved value of your property, allowing you to potentially borrow more than the current worth of the home. This flexibility can be incredibly advantageous when planning your ADU project.

12. Leveraging Rental Income

If you plan to rent out the ADU, using projected rental income as part of your financing strategy can help you qualify for better loan options or even offset monthly mortgage payments. Many lenders will factor in the potential income, making it easier to secure financing.

Be sure to have a solid rental plan in place! Having a budget for expenses and anticipating your rental income can help depict a more realistic financial picture. This will not only ease your loan application process but also help ensure your investment remains profitable.

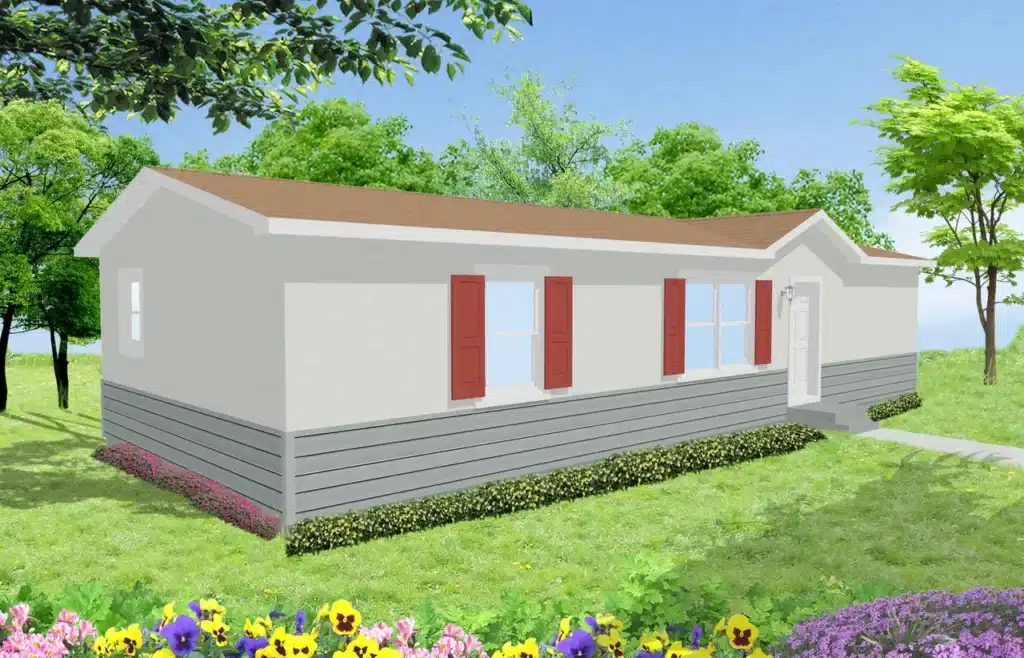

“ADUs in Poway and surrounding communities of San Diego have proven to be a cost effective method of generating income for homeowners or for a means to have affordable housing for mfamily members. Building your prefabricated ADU can save up to 30% in cost and up to 1 year in time.” Says Todd Kesseler www.MyADU4Less.com